Sage Intacct review | ITPro

Miskeyed data can be expensive. It accounts for almost £40bn of revenue lost by UK businesses every year, with a further £25bn left on the table through poor data reconciliation or multiple versions of the truth.

Important though it may be, data entry can often feel like a mind-numbing, time-consuming task – and one that’s perhaps best done in short bursts. Yet one study from Zapier found that three-quarters of respondents spent up to three hours a day on the job, which is a long time to stay focused on something that can impact the bottom line.

Sage reckons it has the answer: artificial intelligence. It’s added AI and machine learning to Intacct, its cloud-based accounting and ERP (enterprise resource planning) solution, to reduce the amount of time spent on AP (accounts payable) data entry. The result should not only be less time spent at the keyboard but fewer mistakes, with AI taking a first pass at the data, for humans to check and post.

We signed up to see how it worked.

Sage Intacct: Submission and recognition

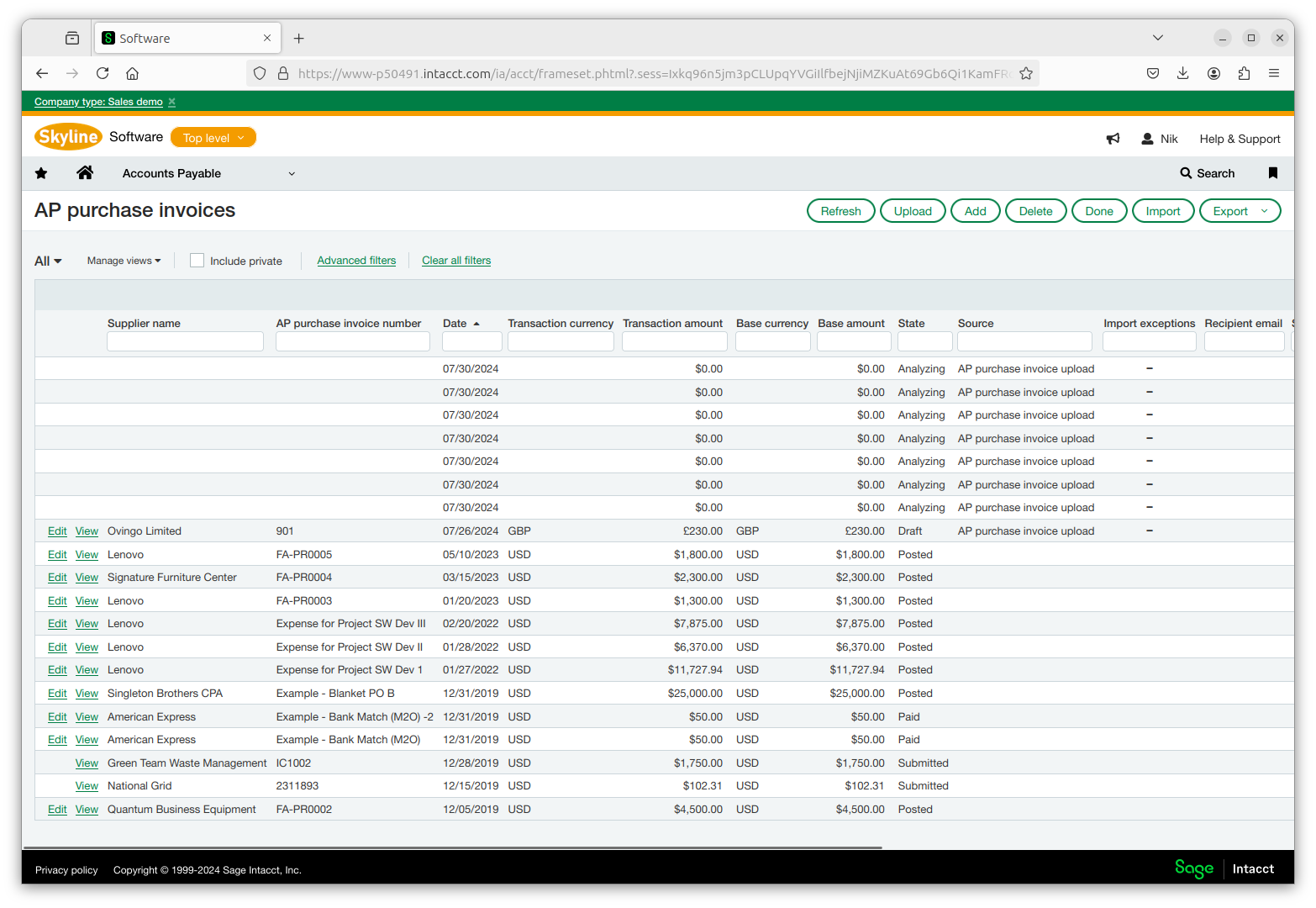

Upload an invoice, and several things happen at once. Most obviously, Intacct extracts the supplier name and address, plus service or product details, dates, and other key data, all of which are necessary to assign items to your accounts. It then applies ‘dimensions’, similar to metadata for business location, department, project, and the like.

Dimensions are used to draw various metrics into different views, like your register of fixed assets, the general ledger, and reports, so you can filter, sort, and present your data however makes most sense at any given moment.

When it’s recognized everything it needs, Intacct compares the captured details against existing transactions to make sure you’re not going to repay an invoice that’s already been settled, then creates a draft transaction for you to review before posting.

This latter point is important. Sage admits that the system isn’t – yet – perfect, but it’s improving, and you can expect it to get around 15% smarter over your first month of use. Among early adopters processing between 700 and 900 invoices a month, it’s scoring around 90% accuracy.

It’s this accuracy that most interested us and, in our tests, in which we worked with both pounds sterling and US dollar invoices – some real, some mocked up – it did a good job of recognizing amounts and the line items to which they related.

Sage Intacct: AI, ML, and your data

Behind the scenes, Sage is using two kinds of data to refine the system. First, it logs the corrections you make and uses these to improve its ongoing interpretation of your own company’s accounts. Second, it uses aggregate data to improve broader-brush aspects, such as its ability to recognize different invoice layouts and the way they set out company details, line items, and amounts.

There will be a slight lag in the AI’s ongoing improvement, as the machine learning routine kicks in once a day. So, if you made a correction this morning and uploaded a similar invoice this afternoon, you may find it repeats its original mistake. Twenty-four hours later, it should know better.

Beyond Sage, the general concept of AI – and the machine learning that underpins it – has had something of a mixed reception. So should you worry if your account data is used to train a financial AI? We don’t believe so. Sage, as the trusted intermediary, is governed by strict privacy laws (not to mention a desire to maintain its good name), the data it holds for UK customers is stored within the European Union, and neither your personal nor your supplier data will ever be shared with other users.

Besides, if you’ve chosen to use a cloud-based accounting platform anyway, as is now largely the norm, you’re already trusting that same data to a third party for safekeeping.

Sage Intacct: Capturing data

The system is built to work with unencrypted PDF, PNG, Jpeg, and Tiff files, of fewer than 200 pages and running to 20MB or less. It’s up to you whether you upload invoices directly or email them to a dedicated ingestion address, and automation is optimized for US Dollars. Although other currencies are “usually recorded correctly”, per Sage, it will default to US Dollars if it can’t work out what’s been used.

Depending on how you prefer to work, you might choose to hand out the ingress address to your suppliers so they can submit invoices directly for the system to process. They won’t go into your books until you approve the recognition, after all, but you will need to give those suppliers some pointers.

If an invoice needs supporting documentation like receipts to substantiate an expense item, for example, these should be uploaded separately as an attachment. Likewise, although you can manually upload 30 invoices at a time (and you or your suppliers could send 200 as attachments on a single email), they’ll each need to be a separate document. If not, they’ll appear as a single draft invoice for approval.

Should you decide to hand out your import email address to suppliers, it’s therefore essential that they know – and follow – these rules if they’re going to be paid on time. If they don’t, and Intacct throws up an error, it will send them an email explaining the problem, as it would for any internal user, which they may not receive if they submit invoices from an unmonitored inbox. Ultimately, it’s up to you whether you want to head down this route or play the part of intermediary yourself.

When uploading invoices manually, you can choose whether line items are amalgamated or listed separately on a case-by-case basis. And, if you prefer to upload via email, you can set this as a global preference (the default is to enter a single line summarising the invoice total). As the PDF invoice is kept alongside the entry to which it relates, you can still open the original should you need a more in-depth explanation of its contents in the future.

We found that the system generally took a couple of minutes to analyze a single invoice, but your time would probably be better spent submitting several simultaneously and coming back to batch process them when they’ve all been ingested. Once an invoice has been recognized, you can go in and edit the captured details, often by selecting options like base currency, account, department, and so on, from drop-down menus. The process is form-based and the tax and currency sections are initially collapsed, helping to reduce complexity.

There’s plenty of other help along the way. For example, process an invoice from a supplier who doesn’t already appear in your records, and you’ll be warned that they’re unknown – but rather than being forced to manually step out to the suppliers module, you can add them there and then.

Intacct warns that it doesn’t currently support Firefox’s built-in PDF viewer, and Sage recommends making Adobe Acrobat Reader the default PDF viewer through Firefox’s options. However, we conducted our tests using a mix of Firefox and Opera and could see our invoices in both.

Sage Intacct: AP and AI

Sage acquired Intacct in 2017, when demand was shifting from monolithic ERP suites, as part of its plans for ‘winning in the cloud’. Intacct itself had launched almost two decades earlier as one of the first cloud-native platforms of its type.

Since the acquisition, Sage has built on the offering and broadened its focus to encompass new markets, including France, South Africa, Germany, and the United Kingdom. Updates come roughly every three months and although most features are common across all territories, a few are market-specific or surface in some territories ahead of others. For a full list of new features and the markets to which they apply, check the published release notes.

So, is AI a good fit for AP? It certainly feels that way. This is a focused implementation with a clear and quantifiable benefit. The fact it’s being trained on predictable data, and that Sage can gather that data at scale, means it should quickly get smarter – and even today we were impressed by its ability to recognize items in a variety of invoice layouts and generate draft transactions for approval.

We can see this being a genuine time saver going forward, and one that could help businesses to claw back some of the revenue they may be losing to data entry mistakes.

Source link